Members of the Pension Plan enjoy income protection benefits, which provide them with a proportion of pensionable salary if they are unable to work in the medium to long term. The base level of cover is 50% of a member’s pensionable salary and will be payable for a term of up to 5 years provided that members meet and agree to the terms and conditions of both the Company and the insurers at the time any claim is made. If the claim is accepted, the income protection will commence after you have been off work for a period of 52 weeks.

The Company has established a Group Life Assurance Scheme, this is sometimes referred to as Death In Service benefit, designed to help protect your family should you die while employed by Fenner. This is paid for by the Company.

Under this policy, all UK employees, who are not a member of a Fenner Pension arrangement, will be covered for 2 times their pensionable salary in the event of death while employed by the Company.

If you chose to join the Pension Plan, your cover will increase to 4 times your pensionable salary.

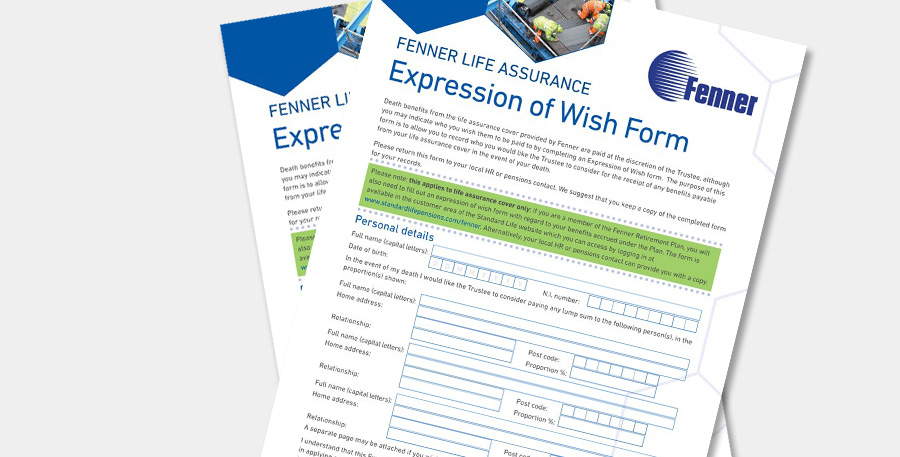

Please complete this form so that the trustee knows who you would like to receive any benefits due in the event of your death.

If the combined total of your lump sum payment under the Group Life Insurance Scheme and your total pensions savings exceeds the Lifetime Allowance, currently £1 million for the tax year 2017/18, your estate may be taxed on any amount over the Lifetime Allowance (maybe subject to change).